Transportation Property Tax Appeals in Texas

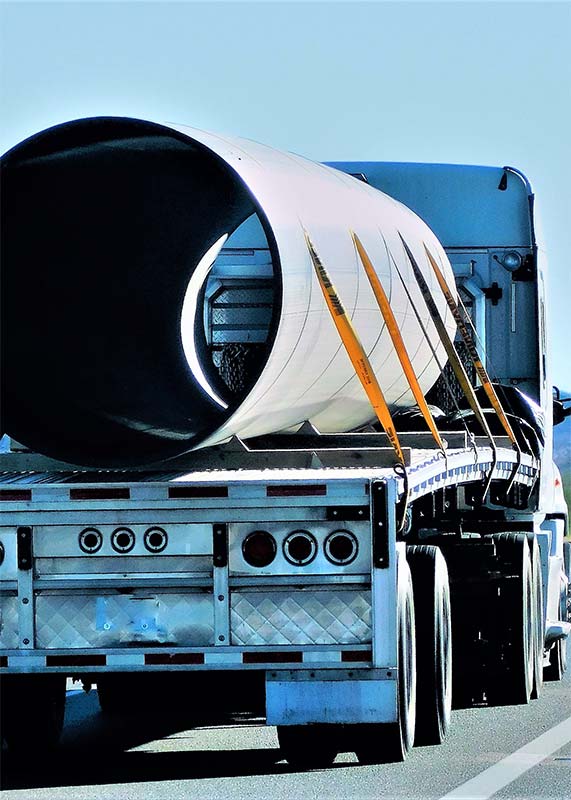

Reduce transportation property tax and marine vessels, tugboats, rail equipment, trucking fleets, and aviation assets. Expert valuation of mobile equipment, specialized transportation infrastructure, and vessel operations across Texas.

Common Valuation Problems:

Can’t find your property type? Contact us—we handle all specialized industrial classifications.

We advocate for reduced transportation property taxes by applying industry-specific depreciation, operational condition assessments, and mobile asset situs analysis.

Transportation property tax appeals in Texas reduce assessments for marine vessels, tugboats, rail equipment, and fleet vehicles by applying specialized depreciation for mobile assets, documenting operational wear, and accounting for limited situs taxation rules.

How We Reduce Transportation Property Taxes

Mobile Asset Depreciation Analysis

Transportation equipment experiences accelerated depreciation from continuous operations, harsh environments, and high utilization. We document actual operational wear versus appraisal district generic assumptions.

Situs & Multi-Jurisdiction Allocation

Mobile equipment operating across multiple jurisdictions requires proper situs determination. We advocate that you’re not over-taxed in any single location and properly allocate value based on actual operational presence.

Specialized Market

Comparables

Generic appraisers struggle with transportation assets. We use industry-specific comparable sales from marine brokers, rail equipment dealers, aircraft brokers, and fleet auction data to prove appraised values.

Marine & Transportation Property Tax Questions

Everything you need to know about Transportation & Marine Property Tax Reduction in Texas